Securing a stable financial future for children is a paramount concern for any parent. The significance of saving for kids’ future cannot be overstated, as it ensures that they have the necessary resources for education, emergencies, and future endeavors. One effective way to achieve this goal is through Fixed Deposits (FDs). Fixed Deposits offer a safe as well as a reliable investment option with guaranteed returns, making them an excellent choice for long-term savings. They provide financial security by locking in a fixed interest rate, which helps grow your savings over time. In this blog, we will emphasize on Fixed Deposit Plans for Children. You will also learn how our Swarnim Bhavishya Yojna proves to be the Best Investment Plan for Kids.

Best Child Plan Fixed Deposit Schemes at Samridh Bharat

Our Traditional Fixed Deposits:

At Samridh Bharat Cooperative Society, we aim to promote financial savings and wealth creation for your and your children’s better future.

Our fixed deposit schemes offer you the highest interest rates than the private and public sector banks. Depending upon the tenure of your investment, you can earn up to 12.25% annual interest on your deposited amount.

Here’s how our fixed deposit plans pay:

| Investment Tenure | Interest Earned (Yearly) |

| 12 months | 10.5 % |

| 24 months | 11.25 % |

| 36 months & above | 12.25% |

By starting to invest with a minimum of INR 10,000, you can ensure high returns on your deposit. Over time, our FDs help you not just accumulate wealth but also protect it by adjusting for the inflation rate.

Our Investment Plan for Kids

The Swarnim Bhavishya Yojna is one of our highest-return-generating deposit plans, dedicated to enabling parents secure their kids’ future. This plan lets you to deposit a lump-sum amount of a minimum of INR 10,000 and get ten-times (10x) the principal deposit amount after 19 years.

Here’s a demonstration of how the Swarnim Bhavishya Yojna pays you:

| Principal Amount | Amount after 19 Years |

| INR 1,00,000 | INR 10,00,000 |

| INR 5,00,000 | INR 50,00,000 |

| INR 10,00,000 | INR 1,00,00,000 (1 Crore) |

Our deposit plans, including the investment plans for kids, also let you prematurely withdraw your principal amount. In such a case, you still earn lucrative interest on your deposit as per the prematurity withdrawal chart.

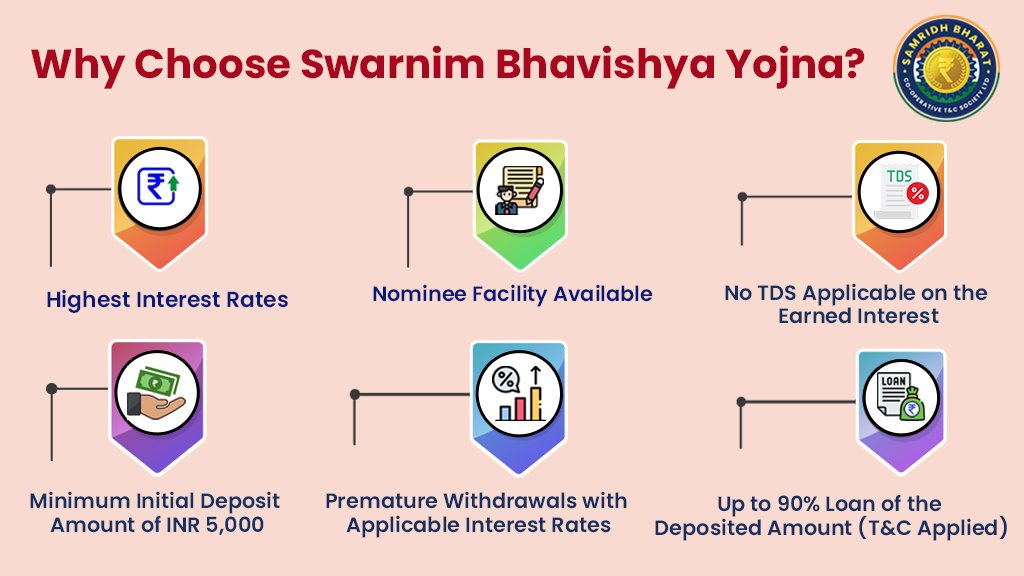

Reasons to Invest in Swarnim Bhavishya Yojna:

- Higher Interest Rates than Mainstream Private & Public Sector Banks.

- Minimum Initial Deposit Amount of INR 10,000/- and further in multiples of INR 100 – 500.

- No TDS Applicable on the Earned Interest.

- Premature Withdrawals with Applicable Interest on the Deposit.

- Nominee Facility Available.

- Loan facility of up to 90% of the deposited amount (T&C applied).

Comparing Our Child Plan Fixed Deposits With Other Investment Options Government’s Investment Plan for Kids:

The government of India also runs schemes dedicated to kids. However, you may find Samridh Bharat’s deposit schemes much more attractive and profitable. Here’s a comparison of the government plan versus Swarnim Bhavishya Yojna.

| Govt. Scheme | Swarnim Bhavishya Yojna (SBY) |

| Only for girl child | For both boy and girl child |

| Oly a single account allowed per girl | No cap on SBY accounts per child |

| Maximum 2 girl children’s account per family | No cap on the number of SBY in the family |

| Maximum interest earned up to 8% p.a. | Interest earned at a rate of 12.25% p.a. |

| Maturity Period of 21 years | Maturity in 19 years only |

| Maximum investment amount ₹ 1,50,000 p.a. | No cap on SBY accounts per child |

| Premature withdrawals of only up to 50% or investment after the girl’s age reaches 18 | No cap on premature withdrawal amount (Interest payable as per prematurity withdrawal rates) |

Mutual Funds: When it comes to a comparatively safer investment options in the securities markets, mutual funds do the job. Still they are not immune to the risks of the market. Here’s an eye-opening comparison, why Mutual Funds may not ultimately be the best investment options.

- Market Risk: Mutual funds are directly affected by the market conditions and therefore are subject to the risks of the securities market.

- Fees and Expenses: Managing mutual funds require the asset management companies (AMC) and the fund managers to charge certain management fees and other expenses. This can eat a significant portion of your return.

- Performance Uncertainty: Past performance does not ensure any certainty of future results, offering no guarantee of returns.

- Exit Load: MFs charge an exit load in case the investment is redeemed within a certain period, which can reduce the effective returns.

- Lack of Control & Mismanagement: You do not have control over the specific investments chosen by the fund manager and your funds. Poor management can lead to subpar performance.

- Capital Gains Tax: Profits from mutual funds are taxable as per the short-term and long-term capital gains tax slabs.

- Entry Barriers: Some niche or specialized mutual funds require a higher initial deposit, which may not be ideal for small investors.

On the other hand, the Swarnim Bhavishya Yojna (SBY) is a transparent long-term deposit scheme with assured returns. You can also prematurely withdraw your amount and still get interest rates, that beat the rates of the traditional deposits. There is no management charge involved and the SBY is not subject to the traditional securities market’s risks. This makes the SBY one of the best Child Plan Fixed Deposits you can invest in today. Moreover, it is one of the safest long-term investment options to go with and secure your children’s future.

Samridh Bharat Cooperative Society – Offering High-Return Deposit/Investment Plans

Samridh Bharat Cooperative (Urban) Thrift & Credit Society Ltd. is registered under the Delhi Cooperative Societies Act or the DCS Act 2003.

It holds the registration number 10844. We abide by and strictly follow all the guidelines, rules, and bye-laws registered at the Office of the Registrar Cooperative Societies J6G7+5CJ, Sansad Marg, Old Court Building, Janpath, New Delhi, Delhi 110001.

Based at one of Delhi’s prime locations in Vasant Kunj, Delhi, we are one of the fastest growing urban thrift and credit societies in Delhi. We are providing various investment schemes to our members with higher interest interest rates and enabling them to overcome their financial problems.

To learn more about our regular and Child Plan Fixed Deposit schemes, contact us at 9667837771 and 9667847771. You can also write to us at info@samridhbharat.org.