In today’s fast-paced financial landscape, the importance of financial savings cannot be overstated. A robust savings strategy not only ensures financial security but also prepares individuals for unforeseen expenses and future goals. Fixed deposits (FDs) are a popular and reliable savings option, offering a safe way to earn higher fixed deposit interest rates compared to regular savings accounts. However, maximizing savings potential often requires more than just traditional banking solutions. Cooperative thrift and credit societies provide a valuable alternative, fostering a community-driven approach to financial stability. These societies offer members accessible financial services, including competitive fixed deposit schemes, while promoting thrift and mutual support. By leveraging the collective strength of their members, these cooperatives help individuals cultivate disciplined savings habits, achieve financial goals, and enjoy better returns on their investments.

This blog explores the critical role of financial savings, the benefits of fixed deposits, and how cooperative thrift and credit societies can enhance your financial well-being.

What is a Cooperative Thrift & Credit Society?

A cooperative thrift and credit society is a member-owned financial institution that aims to promote savings and provide affordable credit to its members. These societies operate on the principles of mutual aid and self-help, encouraging members to pool their resources for collective financial stability and prosperity. Members can save money through various schemes and access credit facilities at reasonable rates, fostering a culture of financial discipline and support within the community.

Governance of Cooperative Societies

Cooperative societies, including thrift and credit societies, are governed democratically by their members. Each member typically has one vote, ensuring equal participation in decision-making processes. The management is overseen by an elected board of directors or core members who are accountable to all the members. This governance structure ensures transparency, accountability, and member-centric policies. The societies are also regulated by relevant cooperative laws and government regulations, ensuring adherence to standards and protection of members’ interests.

Higher Fixed Deposit Interest Rates

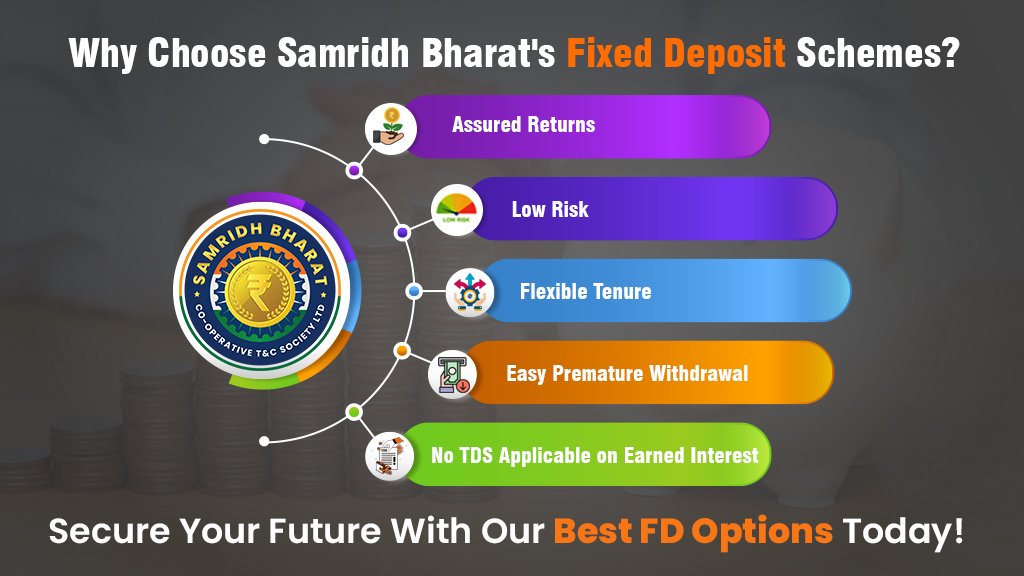

One of the key advantages of joining a cooperative thrift and credit society is the attractive interest rates offered on fixed deposits. They provide significantly higher rates of interest compared to traditional banks. This is possible due to their non-profit nature and efficient management of pooled resources. The surplus generated from operations is returned to members in the form of higher returns on savings and lower loan interest rates. Members benefit from better financial growth opportunities, making these societies an appealing alternative for savers seeking to maximize their earnings.

Samridh Bharat Cooperative exemplifies cooperative finance by offering the highest fixed deposit rates, fostering financial inclusion, and enhancing community well-being. Here, you can enjoy the dual benefits of higher savings returns and a supportive financial environment. All these make cooperative thrift and credit societies a valuable component of personal financial planning.

Samridh Bharat Cooperative Society Providing Higher Fixed Deposit Interest Rate

Samridh Bharat Cooperative Thrift & Credit Society Ltd. demonstrates the principles of cooperative finance through its high fixed deposit interest rates. These rates not only attract members seeking secure savings options but also contribute to the society’s goal of fostering financial inclusion. By offering favorable rates, we enable its members to earn higher returns on their investments compared to traditional banking institutions.

This approach not only enhances individual financial stability but also strengthens the economic resilience of the community at large. This reflects the cooperative’s commitment to empowering its members through prudent financial management and distribution of benefits.

Here is the breakup of our offered plan-wise interest rates:

| Period of Investment | Interest Earned Annually |

|---|---|

| 12 months | 10.5% |

| 24 months | 11.25% |

| 36 months & above | 12.25% |

At Samridh Bharat, you also get the benefits of premature withdrawal and earn applicable interest rates while keeping your principal safe.

Eligibility Criteria for Opening a Fixed Deposit at Samridh Bharat

You can open an FD with us starting with just INR 5,000/- and further in multiples of INR 500.

Starting a fixed deposit at Samridh Bharat Cooperative Society is easy, and it starts with becoming a member. Besides getting the highest fixed deposit rates of interest, you can also open your minor children’s account. Below mentioned are the documents and charges required for onboarding:

Documents Required

- A Government-Issued ID Proof (like Aadhar Card, Voter ID card, etc.)

- PAN Card

- Address Proof (Electricity or Water Bill)

- Rent Agreement (in case of a tenant) Along with the Latest Electricity/Water Bill of the Landlord

- 2 Latest Passport Sized Photos

- Affidavit Declaring that You are Not a Member of Any Other Thrift & Credit Cooperative Society of Delhi

Membership Fee for Adults

Share money – INR 400

Compulsory Deposit (CD) – INR 200

Admission Fee – INR 300 (non-refundable)

Kalyan Fund – INR 250 (non-refundable)

Building Fund – INR 250 (non-refundable)

Onboarding – INR 200 (non-refundable)

Membership Fee for Minors

Share money – INR 400

Compulsory Deposit (CD) – INR 200

Admission Fee – INR 300 (non-refundable)

Onboarding – INR 200 (non-refundable)

Get the Highest Fixed Deposit Rates; Start Today!

We are among the leading cooperative thrift and credit societies in India. We are registered under the Delhi Cooperative Societies (DCS) Act 2003 having registration number 10844.

We are governed by the Office of the Registrar Cooperative Societies J6G7+5CJ, Sansad Marg, Old Court Building, Janpath, New Delhi, Delhi 110001.

We are lead by the fundamental principle of cooperation and economical upliftment of our members. Our superior leadership, committed members and dedicated customer support help us to remain on the top.

Start today! Become a member of Samridh Bharat Cooperative Society and earn the Highest Fixed Deposit Rates of Interest on your hard-earned cash. Call or WhatsApp us today at +91 9667837771 or +91 9667847771.