In India, savings account interest rates offered by private and public banks generally vary, reflecting different banking strategies and customer segments. Public sector banks tend to offer stable but lower interest rates, often ranging from 3.5% to 4.5%, emphasizing broad financial accessibility. Conversely, private banks typically provide higher interest rates, often between 4% to 7%, to attract customers with competitive offerings. However, these rates are applicable only when depositing a certain amount, which is usually on the higher side. Generally, such larger amounts are beyond the saving capacity of the average man and woman. Therefore, they are bound to receive a comparatively lower interest rate.

On the other hand, cooperative thrift and credit societies offer higher interest than traditional banks. Similarly, the Samridh Bharat Cooperative Thrift & Credit Society, pay a significantly higher saving deposit interest rate in Delhi at 7% p.a. This offer is not limited to senior citizens or any specific age group, and the rate is the same for all our members. Plus, joining the Samridh Bharat Society comes with its own benefits, which we will discuss later in this blog.

Why Should You Strive to Earn High Interest from a Savings Account in Delhi?

While most private and public banks offer modest interest on savings deposits, many of us still choose them. However, with inflation rising every year, these rates often become inadequate. Therefore, striving to earn a high interest on savings accounts in Delhi becomes essential. Here are some reasons:

- Maximized Returns: Higher savings account interest rates directly translate into greater earnings. Over time, this compounding effect significantly boosts your savings, making your money work harder for you.

- Inflation Hedge: In an environment where inflation erodes purchasing power, earning a higher interest rate protects your savings. A saving deposit interest rate in Delhi that outpaces inflation helps preserve your wealth.

- Financial Goals: Higher rates accelerate your savings growth, helping you meet goals faster—whether it’s building an emergency fund or planning for future investments.

- Improved Financial Health: Higher interest contributes to overall financial well-being, offering a buffer against unexpected expenses and a secure future.

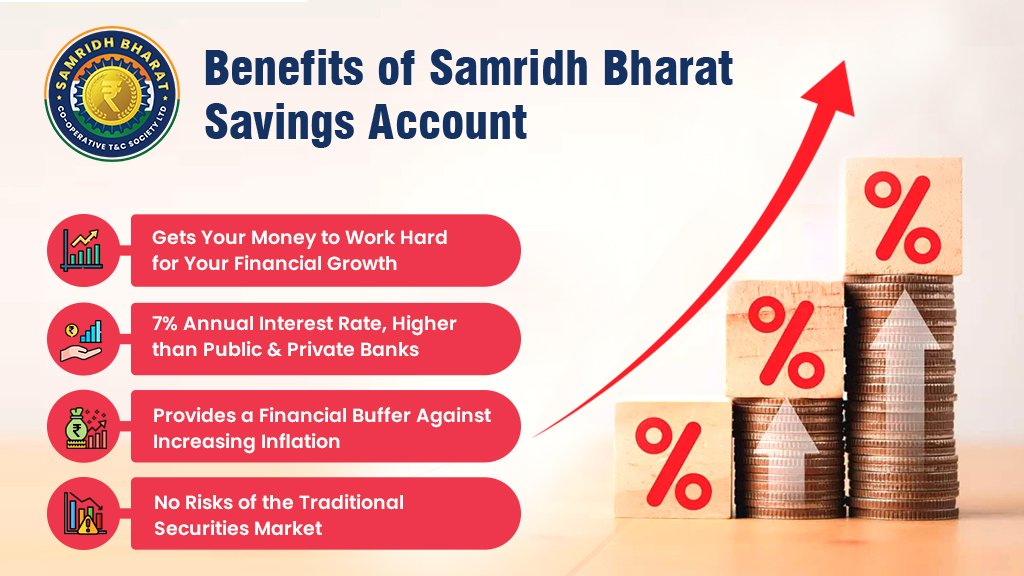

Benefits of the Savings Deposit at Samridh Bharat Society

Let’s understand how our optional or savings deposit account becomes much more valuable for you for long-term financial growth.

A Detailed Insight into How Inflation Eats Up Your Savings

Let’s consider a practical example to show how inflation affects your money:

Scenario

Imagine you have ₹1,00,000 saved in a savings account earning 4% annually. At the same time, the inflation rate is 6%.

Year 1

- Initial Savings: ₹1,00,000

- Interest Earned (4%): ₹4,000

- Total After Interest: ₹1,04,000

- Inflation Impact: ₹6,000

- Adjusted Value: ₹1,04,000 – ₹6,000 = ₹98,000

Even though you’ve earned ₹4,000 in interest, the real value has decreased to ₹98,000. If the same scenario continues in Year 2, the purchasing power will drop further. This demonstrates the urgent need for a high interest savings account in Delhi to beat inflation effectively.

Highest Interest Rate on Our Savings Deposits

Why Samridh Bharat Cooperative Society?

In a scenario of rising prices and stagnant earnings, adopting a strong saving strategy is crucial. Here’s how Samridh Bharat Cooperative Thrift and Credit Society helps you grow your savings with a better saving deposit interest rate in Delhi:

- Higher Interest Rates: At Samridh Bharat we offer a 7% interest rate on your savings deposit, higher than the banks ensuring better returns.

- Flexible Deposit Options: We allow for various deposit schemes with different tenures and interest rates, accommodating different financial goals and preferences.

- Member Benefits: When you become a member of our society, you get attractive and utilitarian welcome gifts.

- Referral Gifts/Bonus: When you refer a new person and he/she becomes a member of the society, you receive various lucrative gifts or bonuses.

- Safe and Secure: We ensure the safety of your deposits through regulatory compliance and strong security measures, offering you complete peace of mind.

- Easy Availability of Loans: Once you have completed six months as a member and fulfilled all the criteria, you can get different types of loans. Please note that the approval of your loan depends upon the availability of funds in the society.

- Community Focus: We also reinforce the cooperative model that benefits all members by pooling resources and sharing profits. This helps enhance the overall value of your savings.

Becoming a member of Samridh Bharat Cooperative Society in Delhi is easy. We offer up to 12.25% annual interest on fixed deposits, along with exclusive investment plans like the Swarnim Bhavishya Yojna for your children’s education, marriage, and more.

To learn more or become a member, call us at 9667837771 or WhatsApp us at 9667847771.

Pingback: Advantages of Selecting the Highest-Interest Savings Account – Samridh Bharat Society

Pingback: Unlocking Better Returns: Choose a Savings Account with Higher Interest Rates – Samridh Bharat Society